Here is brief summary of AMEX's new card:

- 5% cash back on the first $50,000 in purchases per calendar year at U.S. office supply stores and on wireless telephone services purchased directly from U.S. service providers

- 3% cash back on the first $50,000 in purchases per calendar year on the category of your choice from a list of select categories. Categories available:

- Airfare purchased directly from airlines

- Hotel rooms purchased directly from hotels

- Car rentals purchased from select car rental companies

- U.S. gas stations

- U.S. restaurants

- U.S. purchases for advertising in select media

- U.S. purchases for shipping

- U.S. computer hardware, software, and cloud computing purchases made directly from select providers

- 1% cash back on other purchases

- 2.7% foreign transaction fees

- Additional 2% cash back in statement credits on up to $25,000 in purchases made on the Card within the first 6 months (up to $500)

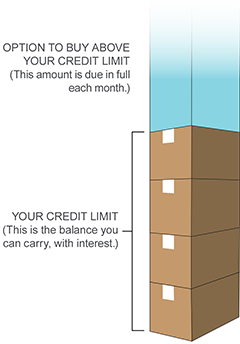

This card has no annual fee and also is somewhat of a hybrid between a typical credit card and a charge card. They advertise this as "More buying power. More cash back. The Card allows you to buy above your credit limit and get cash back on those purchases too - with no overlimit fees, calls to make or steps to take. The amount above your credit limit is due in full each month as part of your minimum payment due. The amount you can spend above your credit limit is not unlimited. It adjusts with your use of the Card, your payment history, credit record, financial resources known to us, and other factors." It can be viewed as:

|

| http://about.americanexpress.com/news/pr/2016/open-launches-simplycash-plus-business-card.aspx |

Now compare this to Chase's Ink Cash Business Card:

- 5% cash back on the first $25,000 spent in combined purchases at office supply stores and on cellular phone, landline, internet and cable TV services each account anniversary year

- 2% cash back on the first $25,000 spent in combined purchases at gas stations and restaurants each account anniversary year

- 1% cash back on all other purchases—with no limit to the amount you can earn

- 3% foreign transaction fees

- $200 bonus cash back after you spend $3,000 on purchases in the first 3 months after account opening

This card also carries no annual fee and is marketed as a "cash back" card although if you happen to have Chase Sapphire Preferred Card of the Chase Ink Plus Business Card then your points can be converted into the much more valuable Ultimate Rewards points that can be transferred to a number of different airlines and hotels.

Comparison

So a side by side comparison of the two cards reveals the following:

As you can see the 2 cards are very similar and the only real difference is that the AMEX SimplyCash Plus Business Credit Card gives you the option of earning 3% cash back on a category of your choosing while the Chase Ink Cash Business Card spreads that out between 2% cash back for both gas stations and restaurants. The AMEX SimplyCash Plus Business Credit Card also has a higher potential earning power of up to $50,000 as opposed to $25,000 for the Chase Ink Cash.

Bottom Line

Overall these are both great cards that offer no annual fee and come with great bonus categories that are worth maxing out if possible. The winner in my opinion would have to go to the Chase Ink Cash Business Card mainly because this card can be combined with one of Chase's premium travel cards such as the Chase Sapphire Preferred or the Chase Ink Plus Business Card to turn these cash back points into the more valuable Ultimate Rewards points which can then be transferred to a number of different airline and hotel partners. If only the AMEX SimplyCash Plus Business Credit Card earned Membership Reward points then it would be the clear winner.

No comments:

Post a Comment